Cannabis

stocks listed on the Nasdaq continued to rally after voters ended

prohibition and approved the recreational use of marijuana in

California, Massachusetts, Maine and Nevada.

Ellen Chang

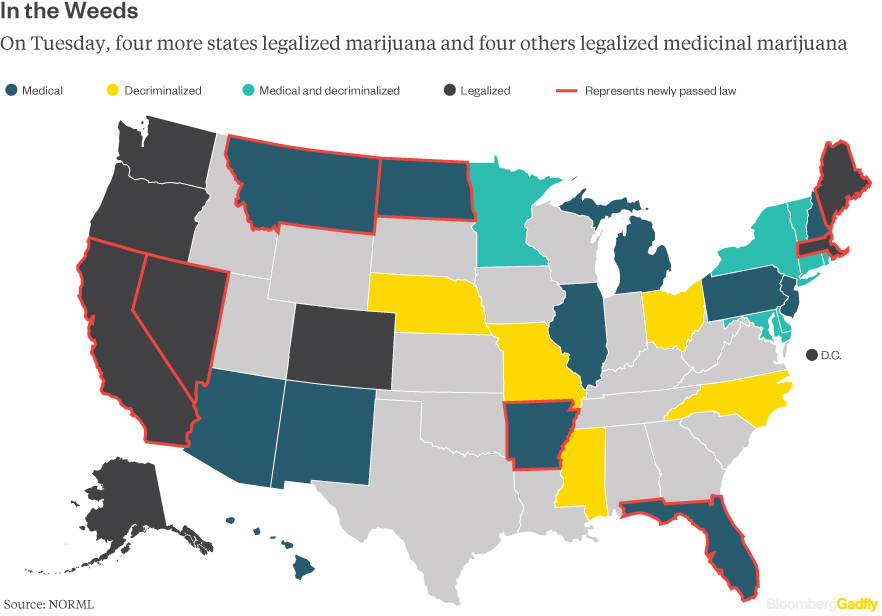

Cannabis stocks listed on the Nasdaq continued to rally on

Wednesday after voters ended prohibition and approved the recreational

use of marijuana in California, Massachusetts, Maine and Nevada while

Arkansas, Florida and North Dakota adopted medical marijuana laws.

Arizona

rejected its measure for recreational use while Montana voters approved

a measure to improve access to medical marijuana providers.

"Whether

they live in blue or red states, voters have spoken in an overwhelming

majority that they want media and recreational marijuana," said Jason

Spatafora, co-founder of Marijuanastocks.com and a Miami-based trader

and investor known as @WolfofWeedST on Twitter. "One election night we

witnessed not just a political shift, but a paradigm shift for cannabis

where prohibition has become untenable."

Interest

in cannabis-related stocks continues to increase from micro cap to

Nasdaq-listed equities and will only continue its upward trend as

investors should be poised for several decades of additional expansion

as more states legalize either recreational or medical use and could

emerge as acquisition targets.

"The

legal cannabis movement scored its most significant victory yet," said

Michael Berger, a former Raymond James energy analyst and founder of

Technical420, a Miami-based company that conducts research on cannabis

stocks. "Although the results of the election will be a turning point

for the legal cannabis industry, we are only in the first inning of what

will be a multi-decade growth cycle.

As legalization measures continue

to go into effect, market sentiment will improve for cannabis stocks and

this should serve as a catalyst for many companies."

The economic impact for these states is immense - California is

estimated to increase to $10 billion market by 2020, while Florida's

medical market should be a $1 billion industry by 2020, he said.

"I

expect the cannabis industry to be a $75 billion dollar industry by

2020," Berger said. "Although many people's estimates are below this, I

take into account more than just the sale legal cannabis because the

ancillary business will benefit significantly."

Several

stocks have been undervalued as investors were skittish and the use of

drugs produced by major cannabis-focused biopharmaceutical companies

have not been widely adopted.

The current options for mainstream

investors in this budding sector are limited to a handful of companies

listed on the Nasdaq, including GW Pharmaceuticals (GWPH) , a U.K.-based biotech company with a cannabis-based epilepsy drug; Insys Therapeutics (INSY)

, a Phoenix company known for its cancer pain management drug but is

developing a cannabis-based drug for the treatment of epilepsy; Cara

Therapeutics (CARA)

, a Shelton, Conn.-based clinical state biopharmaceutical company that

develops and commercializes pain relief drugs and Zynerba

Pharmaceuticals (ZYNE), a Devon, Pa.-based company focused on developing and commercializing synthetic cannabinoid therapeutics.

Being

undervalued means many of these companies such as Cara, Zynerba and GW

Pharmaceuticals are also attractive acquisition targets, said Spatafora.

All three companies are appealing candidates because of their

intellectual property and their pipeline of current and upcoming drugs.

"The intellectual property for GW Pharmaceuticals is based on having

cannabis plant-based drugs rather than synthetic alternatives and in my

estimate is worth $6 billion or roughly $190 per share if bought out,"

he said.

Since

GW Pharmaceuticals is the bellwether company of the cannabis industry

and tends to benefit from positive developments in the sector, the stock

could be poised for headwinds as a result from the increased market

volatility.

"We

continue to view GW Pharmaceutical as the best long-term cannabis

investment due to its deep pipeline of products, its successful FDA

testing results, its Wall Street coverage and its valuation as its

shares are trading well below the average Wall Street price target,"

said Berger. "We continue to view GWPH as a buy opportunity on weakness

from today."

While

there is less research available from analysts, some cannabis stocks

listed on the OTC are also worth consideration, because they will

benefit from the laws that passed in Florida, Nevada and California,

Spatafora said.

Florida's adoption of medical marijuana use could be advantageous for Arcturus Growthstar Technologies (AGSTF)

, which entered into a letter of intent to purchase a Florida farm that

is zoned for cannabis. The state currently has six licensed producers

and expansion will be needed to meet "massive demand," he said.

"They

hedged on the LOI to wait and see if the law passed," Spatafora said.

"The company was pretty wise in this potential acquisition because the

farm already produces $2.6 million in revenue annually."

With Nevada voters approving adult use of cannabis, mCig Inc. (MCIG)

, which used to specialize in lifestyle brands in the vaping and

cannabinoid markets, could benefit. The company founded a construction

division called Scalable Solutions geared toward the Nevada cannabis

cultivation market.

"We

are about to see an explosion of new money come into the state in order

to support the licensed holders and see capitalized holders of licenses

ramp up construction operations to expedite production as the cannabis

supply has already been running at a deficit," he said. "Supply and

demand issues will be an absolute windfall for mCig and this division."

Other stocks which are expected to rise higher include Medicine Man Technologies (MDCL)

, which provides cultivation consulting services and the company has

clients in Arizona, California, Florida, Maryland, Nevada, Oregon, Ohio,

Oklahoma, Ohio, Pennsylvania, Texas and Puerto Rico.

"We

are favorable on MDCL's leverage to the cannabis industry and the

company stands to benefit from ballot initiatives passed in California,

Florida and Nevada," said Berger.

American Cannabis Company (AMMJ)

provides advisory and consulting services for cannabis businesses in

the U.S. and Canada and generates revenue from the sales of products

used in the cultivation, processing and sale of cannabis.

"Although

AMMJ is poised to benefit from the election results, the shares are up

more than 1,600% since September 1, and we are watching how AMMJ trades

to see if there are legs left in this run," he said.

MassRoots (MSRT)

has been called the Yelp of the cannabis industry and its mobile app

can be downloaded only in states where medical cannabis is legal.

"The

election will be a catalyst for MSRT because its user base and

businesses network will benefit from ballot initiatives passing in

California, Florida, Massachusetts, Nevada, North Dakota and Arkansas,"

Berger said.

Three other stocks to keep an eye on include Kush Bottles (KSHB)

, which is focused on providing exit bag products that are in

compliance with regulations; Finore Mining Inc. (FIN: CSE) (FNREF: OTC);

and Terra Tech ( (TRTC) ).

"We

see a lot of opportunity for growth now that new state markets will

open and existing markets will expand and develop," he said. "We are

favorable on Kush Bottles due to the product it provides, its geographic

diversity and its continued execution and shares should continue to

move higher off this news."

Finore

Mining is likely to benefit from the passage of Proposition 64

following its acquisition of KushTown USA, a California-based cannabis

infused products company whose products are sold in more than 500

dispensaries across the state. The company is focused on penetrating new

markets within California as demand for cannabis infused products

continues to grow, Berger said.

Terra

Tech is levered to the results in California and Nevada through its

multiple subsidiaries. The company's Blum medical cannabis collective

has one location in California and four locations in Nevada with two

that are already operational.

"TRTC will also benefit as we expect to see its IVXX subsidiary sell

more cannabis products out of its California and Nevada dispensary

locations," Berger said.