A bevy of state ballot measures passed this week reveal it's only a matter of time before legalized marijuana use is the law of the land in the U.S. Investors are already finding ways to buy into it.

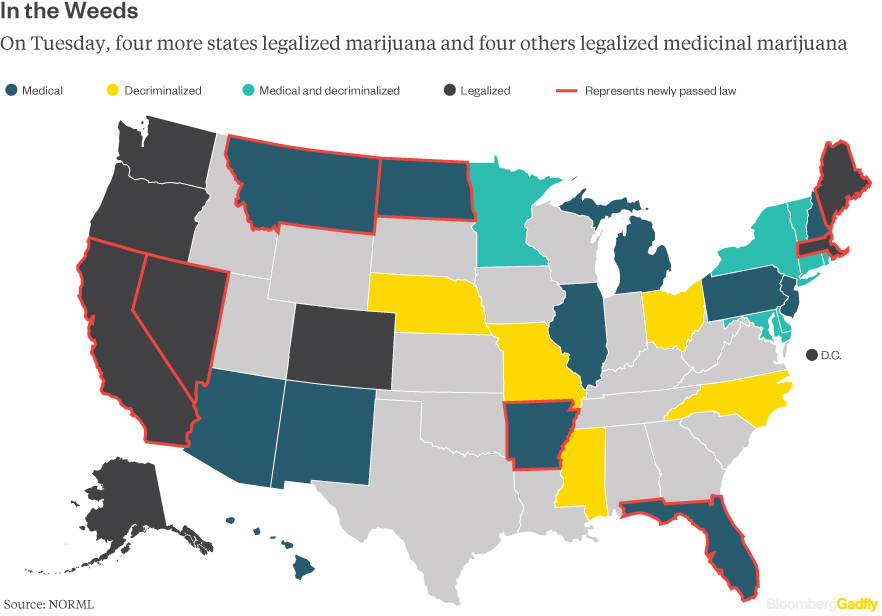

Four states voted on Tuesday to legalize recreational pot use, while four others approved marijuana for medicinal purposes. That brings the number of Americans living in states where recreational marijuana is legal up to 20 percent of the U.S. population. That percentage rises to 58 percent and 66 percent of the U.S. population when counting states where medical marijuana is legal and where states have decriminalized the drug, respectively.

Federal legalization of recreational marijuana use is probably not around the corner. But that's almost beside the point. States are following their own course, and will likely be even more emboldened once states-rights advocates move into the White House, the Senate, and the House of Representatives.

It also doesn't hurt that President-elect Donald Trump has touted his support of medical marijuana -- although his constantly shifting views on just about everything, along with Vice President-elect Mike Pence's opposition to marijuana, cloud that stance. Perhaps that's why a Bloomberg Intelligence index of 32 public companies involved in cannabis-related products fell 7 percent on Tuesday.

Still, despite that drop -- which was concentrated in three pharma companies -- the index is up 181 percent year-to-date.

Besides companies directly related to the production of cannabis, many of which are characterized as pharma firms, plenty of other businesses stand to benefit.

For one, you can bet big tobacco giants R.J. Reynolds Tobacco Co., Altria Group Inc., and Phillip Morris International Inc. are not standing still here. As one top tobacco executive told me last March, these companies already know how to make money in the tightly regulated industry of cigarettes, and marijuana will be no different.

It's no secret e-cigarettes and products that heat tobacco rather than burn it are also used by marijuana smokers. My colleague Tara Lachapelle points out there's $45 billion in potential annual demand for recreational weed in the U.S., and the tobacco companies are a perfect fit to serve this market.

How Pot Can Save Big Tobacco's Future

To find the other side of this trade, look for companies spending big bucks to oppose pot legalization.

The alcohol industry, for example, worries that making marijuana more available will make people drink less alcohol, Bloomberg News's Jennifer Kaplan points out. Sam Adams brewer Boston Beer Co. and Jack Daniel’s exporter Brown-Forman Corp. are among those that call legal weed a threat to their companies.

Pharmaceutical companies, fearing competition for their anti-anxiety and other drugs, have also funded anti-pot measures. One painkiller producer, Insys Therapeutics, scored a victory on Tuesday as Arizona voted down a measure to legalize recreational marijuana. Medical marijuana has been legal in that state since 1996.

Nevertheless, if Tuesday's election taught us anything, it's that America is changing, as are truths that some take for granted. Legalizing marijuana is no different.

No comments:

Post a Comment